-

Why trade Stocks & Futures with Therealworkfirm?

Proprietary Capital Allocation Programme (up to €90 million / year)

Access to US Stocks and Futures from a single account, via Web, Trader Workstation Desktop, Mobile and API.

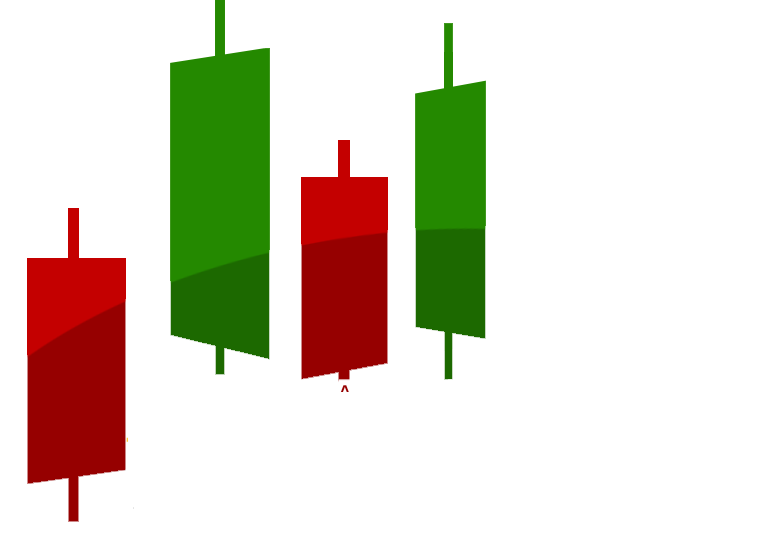

State of the art charting, live quoting, position and portfolio analytics, real-time news streaming, market scanners and more.

Highly trained, friendly and timely Customer Support Team adept in troubleshooting and resolving problems quickly.

Exceptional execution and convenience via quick click order entry, customizable workspaces and market scanners.

Over 100 order types and algos, helping you limit risk, optimize execution and ensure your IP is always protected, all via a simplified trading process.

Looking to attract investor capital? With a Stocks or Futures Therealworkfirm Account, you can list your strategy on our Exchange, attract capital and legally charge for success.

-

Available Trading Platforms

Client Portal - Web Trader

Trader Workstation (TWS) Desktop

Trader Workstation (TWS) Mobile

Trader Workstation (TWS) API

NinjaTrader

MultiCharts

Zorro IB Bridge

IB Gateway

-

Key Platform Features & Benefits

State of the art charting, live quoting, position and portfolio analytics, real-time news streaming, market scanners and more.

Quick click order entry, customizable workspaces and market scanners.

-

Benefits of Trader Workstation vs other platforms

While many trading platforms aim to serve a diverse audience of new to experienced users, Trader Workstation is aimed primarily at professional audiences.

As such, at Therealworkfirm, Trader Workstation gives users access to US Stocks, Futures, FX, ETFs and CFDs. It boasts a powerful yet customisable user interface, the default experience being called Mosaic, with the option to use Classic TWS should users so wish.

Trader Workstation’s built-in tools such as Risk Navigator, Market Scanner, Strategy and Portfolio Builder provide users a variety of alpha discovery, risk management and analytics tools.

Unlike many other trading platforms where only pending, limit or market orders are possible to employ in trading strategies, Trader Workstation equips end-users with a larger, more diverse array of order types, ranging from basic limit to complex algorithmic trading orders.

Additionally, Trader Workstation operates with an open-source API, enabling end-users to use their TWS credentials in all TWS-supported 3rd party trading platforms such as NinjaTrader, MultiCharts among others.

-

Available Order Types & Algos

Trader Workstation provides access to a variety of Order types and Algos, by Product (e.g. Stocks, Futures, etc) and Category. Use-cases range from controlling risk, optimizing execution, ensuring privacy, marketing timing and overall simplification of the trading process.

Categories include:

- Advanced Trading

- Algorithmic Trading

- Limit Risk

- Price Improvement

- Privacy

- Speed of Execution

- Time to Market